52 Week Savings Challenge

It’s a New Year and that means it’s time to do the 52 Week Savings Challenge. Saving money has never been easier, so pay attention.

This post may contain affiliate links. We may receive a commission if you click and purchase something. Please see our disclosure policy for more details.

Would you like to start saving more money? You might want to have the extra cash in a savings account that you can have access to when you need it the most. Whether you are saving to get gifts during the holiday season, want to pay off debt, or would like to get ahead of your finances, you can try the 52 week savings challenge.

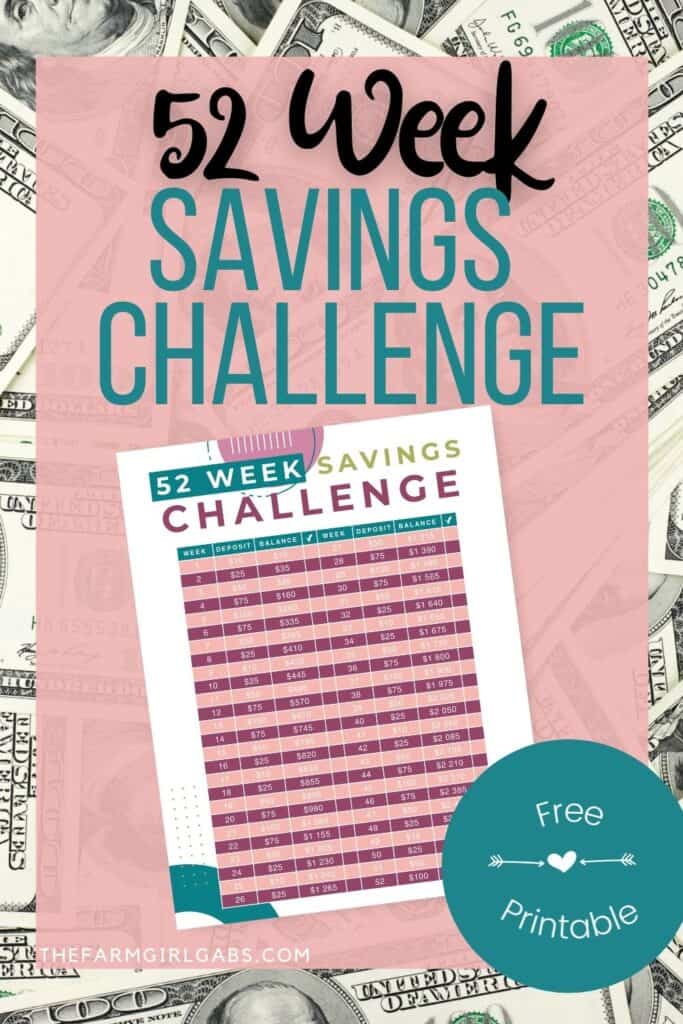

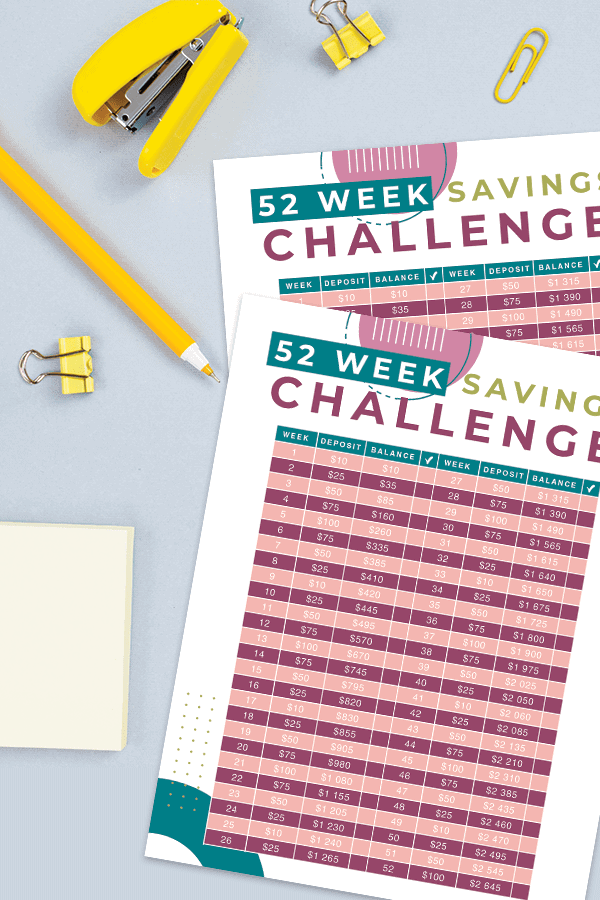

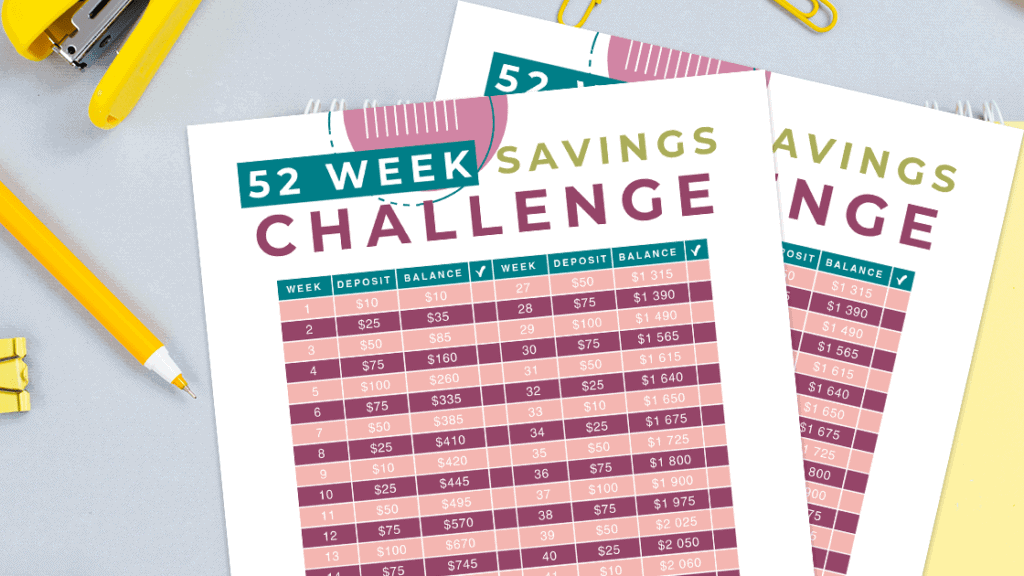

The challenge involves setting money aside over the span of a full year to see exactly how much you can end up saving at the very end. You can download a free printable savings sheet below to help you keep track of your savings.

Download a free 52 Week Saving Challenge Budget Printable here.

Create a Savings Chart

Make a chart or print one online that will allow you to keep track of the amount of money you are saving each week. While you can quickly check bank statements to see how much you are depositing on specific dates, it helps to have a cart for reference to look at each day when you set aside a few dollars.

You can motivate yourself to save more money when you have a chart in front of you. It will keep the momentum going as you notice that you are filling in a spot for each day of the week with a certain amount of money you have put off to the side to deposit into your savings account.

Download the free savings plan chart I created here.

Increase Your Savings Every Few Weeks

Managing home finances can be daunting. Start small and then work your way up to set more money aside as the weeks progress. You may want to start with something as simple as $5 or $10 per week. After saving that amount for four weeks, begin increasing the amount you will add to your savings account by an additional $5 or $10.

If you do this every four to six weeks, you will get in a good habit of getting more money into your savings account instead of spending it on unnecessary purchases, such as fast food and items that you do not genuinely need. The more you are willing to put into a savings account, the more money you will have at the end of the 52 weeks.

Set Aside Your Spare Change

Besides setting cash aside and depositing it at the end of each week into your savings account, you should consider putting your spare change in a spot where you can keep it safe, such as a piggy bank or plastic container.

If you are setting aside some spare change in addition to cash, you will have even more money in your savings account. You can deposit the change you have accumulated at the end of each month to add to your savings total.

When you are serious about saving money, give the 52 weeks savings challenge a try. It may be a bit difficult at first, but if you cut off some unnecessary expenses and stay motivated to take a few dollars out of your paycheck each week, you can end up with thousands of dollars in your savings account.

It will be worth it when you look at your savings account and see how much money you have managed to save in just one year.

Save this 52-week savings plan for later. Pin the image below to your favorite Pinterest board.